5 Benefits of Pasture, Rangeland, and Forage Insurance

If you have livestock or pasture used for haying then Pasture, Rangeland, and Forage Insurance might be something for you to look into. This program was designed specially to give you the opportunity to buy coverage protection for losses of forage that was produced for grazing or harvested for hay which has resulted in destocking, depopulating, or increased costs for feed. The Pasture, Rangeland, and Forage program does not measure the production or loss of products themselves, instead, it uses a rainfall index to determine precipitation for coverage purposes.

1. Coverage on Owned/Leased Acres for Grazing or Haying

One of the best benefits of Pasture, Rangeland, and Forage Insurance (PRF) is that your acreage is covered whether you own it or lease it. If you hay on your land or you graze it, it can be covered as well! When working with a dedicated agent, they will walk through everything you need to know about PRF coverage and answer any questions you might have about what’s included and what might not be.

2. Rainfall Data Used is Based on a Grid System

When determining your insurance policy, your insurance agent can analyze historic rainfall data reported through the NOAA for maximum accuracy when putting together a personalized plan. In basic terms, you will have a trained PRF specialist that will help you determine the best coverage protection for your operations and assets. Benefits are paid out based on the deficit between the historic and the current rainfall data in your area.

3. No Up Front Costs

PRF Insurance agencies, much like our friends at CKP Insurance, have your best interest in mind. This means that your indemnities will go toward your premium first. After your premium is fulfilled, then any indemnities after that come right back to you.

4. Protects From the Risks of Forage Loss due to the Lack of Precipitation

PRF insurance is designed to help protect your operation from the risk of haying or grazing loss due to the lack of rain. Farmers and ranchers can buy coverage as much as 90% spread out over the year during two-month time periods of their choosing. At its very core, it has the producer in mind, helping protect America’s farmers and ranchers from lack of precipitation.

5. Just Insure What You Need

With PRF being available in 48 states, it’s easier than ever to contact a trustworthy agency to get your quote started today. The program is designed to allow maximum flexibility to meet the risk management needs of your operation. It provides protection while allowing you to insure only those acres that are important to your grazing program or hay operation. CKP’s PRF program will provide monthly updates to keep all clients informed on the status of their coverage. They will also use proprietary software to analyze the grid selections for you to maximize return. The enrollment period is 9/1 thru 12/1. You can learn more here.

Official Chad Berger Partner: CKP Insurance

Their trained professionals will walk you through a range of options using risk-assessment tools that will help you manage your risks when there is a drought in your area. The PRF program is backed by the USDA and is subsidized to maximize your benefits.

Those Who Expect More Choose CKP

You Built It. We Can Help You Protect It.

Pasture, Rangeland, and Forage Insurance was designed to help protect your operation from the risks of forage losses that are produced for grazing or harvested for hay, resulting in increased costs for feed.

Anyone can sell you a policy. But CKP Insurance invests the time to understand your needs and develop a strategy that will help you protect and manage your business risks and operations, rain or shine.

Last Updated on 10/13/2022 by Krysta Paffrath

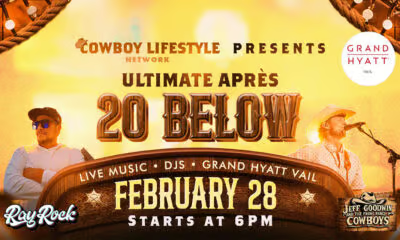

CLN Community Sponsor